Managing Client Expectations in the Early Engagement Haze

The “Confidence Funnel” and Controlled Uncertainty

In the early engagement haze, the job is controlled uncertainty, not false certainty.

This can be described as the Confidence Funnel: as a project moves from early engagement through design development and into contract execution, the range decreases and confidence increases because assumptions are progressively replaced with confirmed information.

Early on, pricing is built on incomplete inputs and open decisions, so the right output is a controlled range and a clear list of what will move cost. As design decisions lock in, scope tightens, market pricing firms up, and the range narrows. By the time the project reaches contract execution, the plan should be largely fixed because the key variables are known, agreed, and documented.

The strongest pre-construction teams don’t fake certainty from the outset. They manage it, communicate it, and guide the client through the Confidence Funnel.

In the early engagement haze, trust is the real deliverable, and it’s won or lost long before the contract is signed.

When the budget feels unstable, the client seeks certainty elsewhere

When trust shifts to external advisors (QS/PM), the contractor loses the role of guide

Conversations turn into debate and defensiveness, instead of decisions and progress

Timelines slow down, rework increases, and late-stage pressure builds

The contractor is treated as a commodity price provider, not a strategic early-engagement partner

Margin gets squeezed late, when it’s hardest to fix

Where early-stage expectation management breaks down

In the early engagement haze, many cost plans unintentionally create mistrust, because they don’t provide a clear, consultative pathway from uncertainty to certainty. The most common issues are:

Transparency that’s either missing or unusable

Clients are given big numbers with little backup, limited assumptions, and no clear logic, so the budget feels arbitrary. Or the opposite happens: the plan is buried in exclusions and caveats to the point where the number becomes meaningless. Either way, the client can’t confidently rely on it.

Insufficient early due diligence

Without early investigation, benchmark testing, and structured assumptions, the contractor simply doesn’t have enough information to put forward a credible range. That leads to weak advocacy, shifting narratives, and revisions that feel like “mistakes” rather than natural progression.

Breakdowns that don’t match how clients think

Unsophisticated or contractor-centric breakdowns force the client to interpret the plan through an external advisor, QS, or PM. When the client can’t understand the structure, they can’t own decisions, and the contractor loses the position of trusted guide.

No pathway to risk reduction

The plan doesn’t clearly show what risk is being carried today, what decisions or confirmations will reduce it, and when those milestones occur. This creates anxiety, surprise, and later-stage pressure to hold numbers that were never properly defined.

Anchoring the client to a single number too early

Once a headline number is shared, it becomes “the budget” in the client’s mind, unless properly defined, even if it was never appropriate to treat it that way. When it changes, confidence drops and the contractor looks unreliable.

Failing to act like a consultant in the early stages

In early engagement, the contractor has to show up as a guide: structuring ambiguity, framing trade-offs, and helping the client make decisions. When the contractor behaves like a traditional contractor, waiting for “complete documentation” before providing clarity, the client fills the gap with external advisors and the contractor becomes a price provider rather than a trusted partner.

Mixing sales narrative and commercial reality

Teams sometimes sell optimism to secure momentum, while the commercial position quietly worsens behind the scenes. The gap eventually surfaces during design development or documentation, and trust takes the hit.

Poor version discipline

When changes aren’t clearly documented, clients experience revisions as random or uncontrolled. Internally, it also creates misalignment between pre-construction, design, and delivery, about what is included and what is an exclusion or assumption.

Unclear ownership of assumptions and decisions

If nobody “owns” key assumptions, they drift. When decisions are not captured, the client believes items are confirmed when they are not. This creates scope creep, rework, and margin pressure.

Over-technical communication

Even when the detail is in the plan, that doesn’t mean the client understands what’s in and what’s out. Assuming understanding creates misalignment and surprises later. Assumptions need to be confirmed, made explicit, and revisited, and the process shouldn’t move forward until everyone is aligned on what the budget includes and what it doesn’t.

CostrixIQ supports Controlled Uncertainty through the Confidence Funnel

CostrixIQ is designed to help teams manage controlled uncertainty in the early engagement haze, then progressively tighten the position as confidence increases and the range decreases.

Early modelling tests assumptions against benchmark references to establish the first credible budget range. This creates a defensible starting point and reduces the risk of anchoring the client to a number that cannot hold.

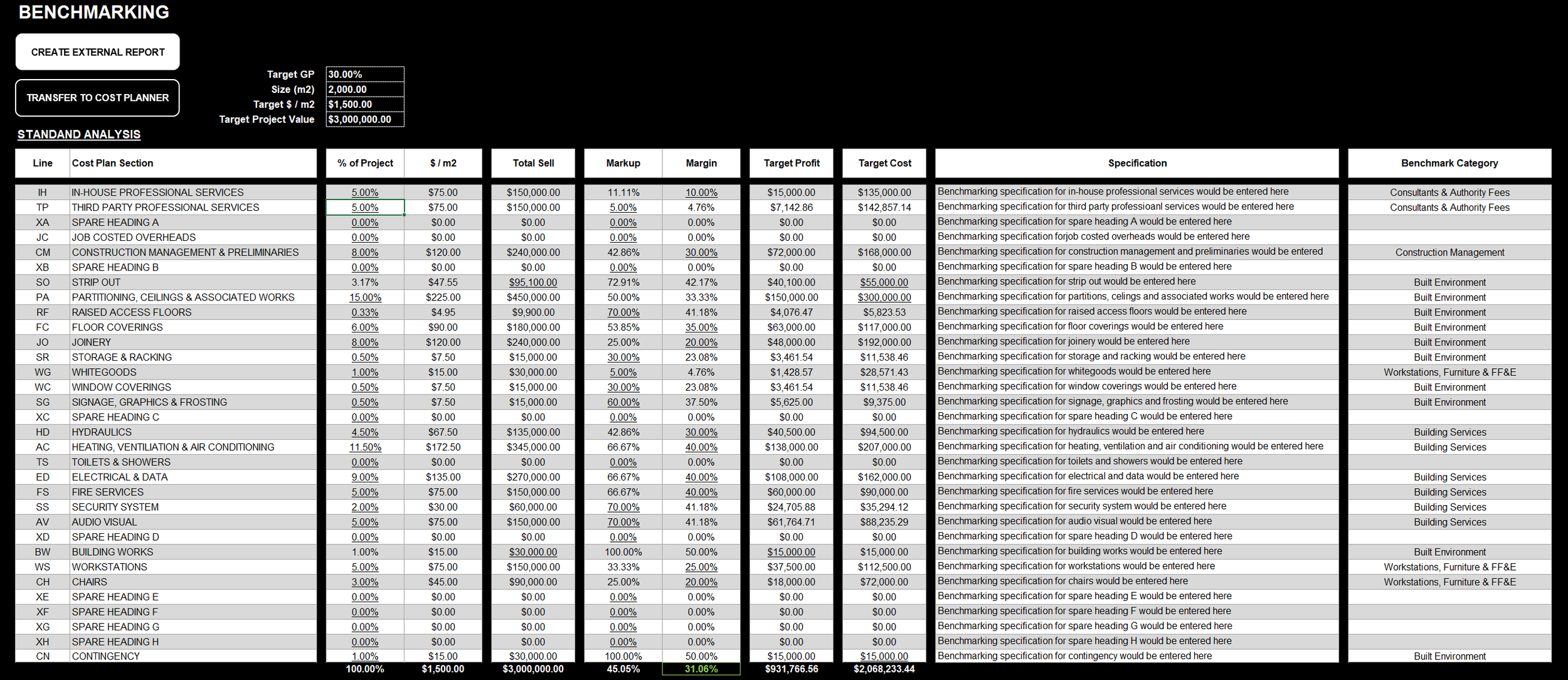

BENCHMARKING MODULE

Projects can be priced in portions, like lego blocks, then those blocks can be clicked together and recombined to form any one of multiple scenarios. This makes it easier to create and compare scenarios in real time, enabling the client to understand the full financial implications across multiple pathways, without rebuilding the cost plan each time.

SECTORS & MULTI-SECTORS

Value engineering ideas and scope enhancements can be packaged in a clearly identifiable way, so the client can see what is changing, why it is changing, and the budget impact. This supports informed decisions and avoids scope drift hidden inside a single headline number.

OPTIONS & OPTION GROUPS

Quantity & Rate, and related reports, provide clear transparency around how the budget and budget range has been formed. Instead of a half-page list of inclusions and exclusions, the report can become a fully detailed inclusions and assumptions schedule, listing every scope line contained within the model, often hundreds of lines, along with the underlying budget assumptions. This makes assumptions visible, traceable, and consistent, which builds trust and improves internal and external alignment.

DETAILED CLIENT REPORTS

A further layer of transparency that adds definition to what is still undefined. This helps lock in expectations earlier by documenting intent, allowances, and scope boundaries in a structured way.

SPECIFICATION CLIENT REPORTS

As the client moves through stages and along the confidence curve, CostrixIQ maintains a clear paper trail of what has moved, why it moved, and by how much. This manages expectations, supports governance, and creates a “no surprises” process.